An increasing number of private and public organisations are taking initiatives to make themselves more attractive as employers. Individual recognition plays a major role in this. Employee gifts also offer an ideal opportunity to optimise your employees’ salaries.

This blog gives you a clear overview of the options and outlines the legal conditions for each one.

Employee gift

Gifts can be given on several occasions that are fiscally and socially beneficial for you as an employer as well as for your employee. Gifts are tax-free (for both the employer and employee) up to a certain amount.

1. Saint Nicholas, Christmas, Year end & birthday

On these occasions, you can give gifts of up to €40 inc. VAT per year and per employee (a total of €40, not €40 per occasion). This amount is 100% deductible for the employer and completely exempt for the employee, both from taxes and social security contributions (exception: social security contributions do apply to birthday gifts). The amount of €40 may also be increased by another €40 per dependent child.

In addition, the VAT can be reclaimed if the value of the gifts is less than €50 exc. VAT.

Please note: for the gifts to be deductible, all employees must receive them.

2. Marriage & legal cohabitation

If one of your employees gets married or starts legally cohabiting, you can give them a gift of up to €245 inc. VAT. This amount is tax-free for both the employer and employee.

Please note: the VAT on marriage and legal cohabitation gifts cannot be reclaimed.

3. Seniority

There are two moments in an employee’s career when you can give them a tax-deductible seniority bonus:

- At 25 years of service (maximum 1 x the employee’s gross monthly salary inc. VAT, or maximum 1 x the average gross monthly salary incl. VAT in the company)

- At 35 years of service (maximum 2 x the employee’s gross monthly salary inc. VAT, or maximum 2 x the average gross monthly salary inc. VAT in the company)

Please note: the seniority bonus is exempt from social security contributions but is not a deductible cost for the employer. In addition, the VAT on these gifts cannot be reclaimed.

4. Pension & early retirement

When an employee retires, you can give them a gift of up to €40 inc. VAT per full year of service. However, the total amount given needs to be at least €120 inc. VAT and no more than €1,000 inc. VAT.

Retirement gifts are exempt from social security contributions up to €1,000 inc. VAT. For taxes, there is no cap here, as long as you don’t go above €40 inc. VAT per year of service. In addition, the VAT on these gifts cannot be reclaimed.

5. Birth & special occasions

You can also give gifts on other special occasions, like the company’s anniversary or the birth of an employee’s child. The value of this gift should be ‘low’ (maximum €50 inc. VAT).

This amount is exempt for the employee but not for the employer. If the purchase value of the gift is less than €50, the VAT can be reclaimed in full.

6. Official honourable award

An official honourable award isn’t something that happens every day. It refers to an honourable award given to one of your employees by an external party.

- Examples include: a medal of honour or knighthood, a decoration, a laureate of labour…

A gift for an official honourable award may not exceed €120 inc. VAT.

Legal framework: summary

Gifts can be given on several occasions that are fiscally and socially beneficial for you as an employer as well as for your employee.

| Gift occasion | Fiscal policy for the employer | Fiscal policy for the employee |

| Saint Nicholas, Christmas & Year end | 100% deductible up to €40 per employee per year Extra: €40 per dependent child | 100% up to €40 per year Extra: €40 per dependent child |

| Birthday (or patron saint) | 100% deductible up to €40 per employee per year Tax deductible Not exempt from social security contributions | 100% up to €40 per year Tax deductible Not exempt from social security contributions |

| Marriage or legal cohabitation | 100% deductible up to €245 per employee per year | 100% up to €245 per year |

| 25 years of seniority | Up to max. 1 x gross monthly salary Not tax deductible Exempt from social security contributions | 100% up to max. 1 x gross monthly salary |

| 35 years of seniority | Up to max. 2 x gross monthly salary Not tax deductible Exempt from social security contributions | 100% up to max. 2 x gross monthly salary |

| Pension and early retirement | 100% up to €40 per year of service Min. €120 Max. €1000 | 100% up to €40 per year of service Min. €120 Max. €1000 |

| Birth and special occasions | - Not tax deductible | 100% up to €50 per year |

| Official honourable award | 100% deductible up to €120 per employee per year | 100% up to €120 per year |

Please note: all amounts are including VAT

Example

An employee is going to start legally cohabiting in 2025 and has two dependent children.

The employer has decided to give them gift vouchers for the following occasions in 2025: Saint Nicholas, Year End, marriage/legal cohabitation and Christmas. The maximum amount the employer can give to remain exempt:

- €245 for legal cohabitation

- €40 + €80 (2 x €40 for dependent children) = €120 in total for Saint Nicholas, Year End and Christmas.

Total: €365 in gifts in 2025, deductible for the employer and exempt for the employee.

Gifts

Physical gifts

Build better relationships with beautiful gifts for any occasion. Would your business partner/employee prefer fragrant flowers, delicious chocolate or a sharing basket? You know best what to choose.

Score some extra points by personalising your gift or its packaging. This way the lucky recipient will never forget who the gift was from. You can also add a message to thank, congratulate or give your employee or business partner a bit of a boost – turning it into a unique gift.

Gift cards

Trying to find a personal gift for everyone often seems like an impossible task. But it can be done. More and more companies are turning to gift cards that the employees or business partners can use to choose their own gift from a range of participating retailers. Gift cards also come with another benefit: they aren’t subject to VAT. For this reason, and the fact that employees get to choose for themselves, gift cards are becoming more and more popular each year.

A lot of retailers offer gift cards. The downside is that gift cards often have a limited validity and, as the giver, you are again choosing the gift on behalf of the recipient. To avoid that, consider using providers like Pluxee, Edenred, Monizze and Kadonation.

These companies offer gift cards redeemable at a range of affiliated partners so that every employee or business partner has plenty of choice when it comes to spending their gift card. This way, the recipient can choose the gift they really want.

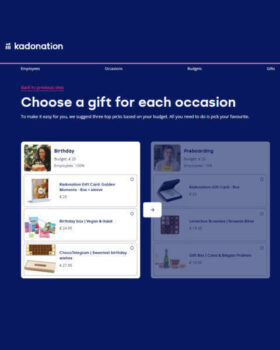

Kadonation Gifts

At Kadonation, we even take it a few steps further. Firstly, we offer a range of physical gifts: brownies, drinks, flowers, cake, gift baskets… There’s something for everyone.

Secondly, we also have the Kadonation Gift Card that can be combined and split, and is redeemable at over 90 popular shops (such as Decathlon, Bol.com, AS Adventure, Coolblue, Zalando, ZEB, Torfs…) and charities.

The gift voucher can also be completely customised with the recipient’s name, a personal message and your company logo or other branding. Our physical gifts can also be personalised with a logo and/or a personal message.

On top of that, we offer the ultimate choice concept: Kadonation Smile. The simplest way to give the freedom of choice. Together, we’ll put together a range of gifts to match your budget. The recipient can then choose their dream gift on a gift website that is completely personalised with your logo, company colours and personal messages.

And of course, our gifts also meet all the conditions for you to get the most out of the legal conditions described in this blog.

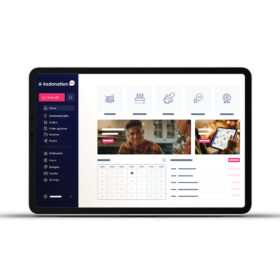

Kadonation Select

In addition to the Kadonation Gifts, we have also developed an all-in one gift platform for people-focused companies: Kadonation Select.

With our intuitive platform, it takes you just minutes – not hours – to give hundreds of gifts. Boost your sales & loyalty by including everyone. Plus you can make life even easier by automating your gift and reward policies.Mathilde Van Vaerenbergh

Read more by Mathilde Van VaerenberghRelated stories.

Fiscally beneficial business gifts in 2026 (for Belgium)