Business gifts

Both existing and potential business partners deserve the same level of attention and appreciation you give to your employees. But sometimes words aren’t enough to express how important they are to you. That’s what makes a business gift the perfect solution. But remember that there are so many different types of gifts. So think carefully about the message you want to send, then choose the most appropriate gift.

VAT

The VAT on business gifts can be deducted for gifts up to a value of €227 (ex. VAT). This amount is per recipient and per year.

Note:

If you give gifts to several people within the same company, the total value of these gifts may not exceed this limit.

If you give a business gift with a value higher than €227, the tax authorities consider the following conditions to determine deductibility:

- If the recipient of the gift bought it themselves, and could have deducted less than 30% of the VAT, the VAT is not deductible.

Example: if the recipient is a private individual, the VAT is not deductible.

- If the business gift serves a commercial purpose for the recipient.

Example: if you give a plumber a surfboard, this gift serves no commercial purpose.

Note:

The VAT is 100% deductible if your gift serves a commercial purpose and the recipient can deduct more than 30% of the VAT if they bought it themselves.

Important: Do you receive a personal contribution for corporate gifts from your business partners? Up until the end of 2023, you could deduct this personal contribution (excluding VAT) from your expenses. If the expenses fell below the Deduction Exclusion Decree (BUA) threshold amount, you were allowed to deduct the VAT on the expenses. The Decree sales tax calculation method for the BUA threshold amount states that this is no longer allowed as of 1 January 2024. From that date, when calculating whether the BUA threshold amount has been exceeded, you may no longer deduct the personal contribution from your expenses. Total expenditure must then be assessed against the threshold amount.

General tax rule:

According to Dutch tax rules, a business gift is occasional, unreciprocated and for an existing relationship. Gifts to attract new customers therefore simply fall under business expenses and are fully deductible.

Income tax

For income tax purposes, business gifts fall under ‘representation costs’. These are part of the mixed costs category, which means they are only partly deductible. The costs for business gifts are 80% deductible and the remaining 20% of the amount is added to the profit again at the end of the financial year.

As of 2024, mixed costs are not deductible from profits up to a fixed amount of €5,600 (2023: €5,100 / 2022 €4,800). You can also choose not to deduct 20% of the expenses and therefore not to opt for the fixed amount.

Corporate tax

For corporate tax, things work slightly differently. A company subject to corporate tax may not deduct up to €5,600 of mixed costs from its profits. Or 0.4% of the company’s total wage bill, whichever is higher.

There is also an alternative corporate tax arrangement that allows companies to as standard deduct only 73.5% of mixed costs, and therefore 26.5% are non-deductible.

Gifts

Physical gifts

Build better relationships with beautiful gifts for any occasion. Would your business partner / employee prefer fragrant flowers, delicious chocolate or a sharing basket? You know best what to choose.

Score some extra points by personalising your gift or its packaging. This way the lucky recipient will never forget who the gift was from. You can also add a message to thank, congratulate or give your employee or business partner a bit of a boost – turning it into a unique gift.

Gift cards

Trying to find a personal gift for everyone often seems like an impossible task. But it can be done. More and more companies are turning to gift cards that the employees or business partners can use to choose their own gift from a range of participating retailers. Gift cards also come with another benefit: they aren’t subject to VAT. For this reason, and the fact that employees get to choose for themselves, gift cards are becoming more and more popular each year.

A lot of retailers offer gift cards. The downside is that gift cards often have a limited validity and, as the giver, you are again choosing the gift on behalf of the recipient. To avoid that, consider using providers like Giftcards.nl, Primera and Kadonation.

These companies offer gift cards redeemable at a range of affiliated partners so that every employee or business partner has plenty of choice when it comes to spending their gift card. This way, the recipient can choose the gift they really want.

Kadonation Gifts

At Kadonation, we even take it a few steps further. Firstly, we offer a range of physical gifts: brownies, drinks, flowers, cake, gift baskets… There’s something for everyone. Secondly, we also have the Kadonation Gift Card that can be combined and split, and is redeemable at over 90 popular shops (such as Bol.com, Rituals, Coolblue, Zalando, HEMA, Dille & Kamille & Decathlon …) and charities.

The gift voucher can also be completely customised with the recipient’s name, a personal message and your company logo or other branding. Our physical gifts can also be personalised with a logo and/or a personal message.

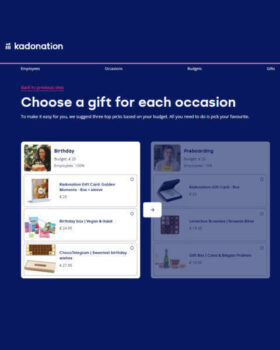

On top of that, we offer the ultimate choice concept: Kadonation Smile. The simplest way to give the freedom of choice. Together, we’ll put together a range of gifts to match your budget. The recipient can then choose their dream gift on a gift website that is completely personalised with your logo, company colours and personal messages.

And of course, our gifts also meet all the conditions for you to get the most out of the legal conditions described in this white paper.

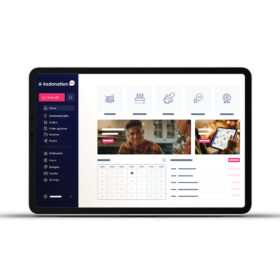

Kadonation Select

In addition to the Kadonation Gifts, we have also developed an all-in-one gift platform for people-focused companies: Kadonation Select. With our intuitive platform, it takes you just minutes – not hours – to give hundreds of gifts. Boost your sales & loyalty by including everyone. Plus you can make life even easier by automating your gift and reward policies.

Mathilde Van Vaerenbergh

Read more by Mathilde Van VaerenberghRelated stories.

Guide to the work-related costs scheme in 2026 (for the Netherlands)