Employees are the lifeblood of an organisation, and should be cherished. That’s why more and more private and public companies are taking initiative to increase their attractiveness as an employer. The core value here is personal appreciation, which you can convey to your employees in various forms, including a heartfelt thank you, an unexpected message or a physical gift.

Employee gifts also offer the ideal opportunity to optimise the salaries of your staff. The amount exempt from taxes per occasion is prescribed by law (in this case Belgian law). This amount can also be increased if the employee receiving the gift has dependent children.

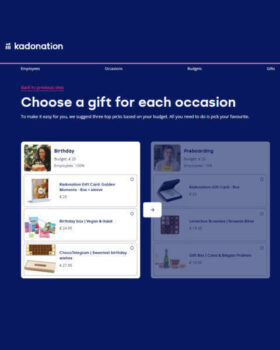

Employee gifts come in all shapes and sizes, from a bouquet of flowers to chocolate, wine or beer packages to a little extra on the pay slip. These are often classic gifts that aren’t always what your staff want. So you need to put some thought into choosing. If you want to let your employee choose and give them a gift that’s a definite winner, go for the Kadonation Gift Card. The best way to put a smile on every employee’s face.

Worried that a gift card is less personal? We don’t see it that way. With the Kadonation Gift Card, not only are you giving them the choice of more than 80 retailers in one gift card but you can also add a unique message. This means you really can give everyone a personalised gift.

So when is the best time to give a staff gift that has both tax and social benefits for you as an employer and for your employee? These different occasions are laid down by law and include classics such as Christmas or New Year’s Eve, Sinterklaas, weddings, birthdays and work anniversaries. Did you know that you can also give a tax relief gift on your company’s birthday?

Isabel

Read more by IsabelRelated stories.

Fiscally beneficial business gifts in 2025 (for the Netherlands)

8 reasons to start investing in employee birthday gifts.

A little extra in your pay cheque or a perfect gift? What would you choose?

Receive new gift inspiration every month!

The latest trends and gift tips delivered straight to your inbox. What’s not to love?